We’re expanding access.Number of states with in-person locations

“When we look at the holders of all the certified accounts to date, 75% are new to the bank. “Being banked is not just part of the mix of financial stability, but the foundation of financial stability,” Mintz said. “You can use them to pay your bills, manage your money, and you don’t have to go out and incur the costs of a check-cashing service or buy money orders and spend time and potentially risk your health amid COVID-19 to do so.”Īccording to the FDIC’s most recent study of unbanked and underbanked households, about 63 million adults either had no accounts or did not use one regularly to manage their money.

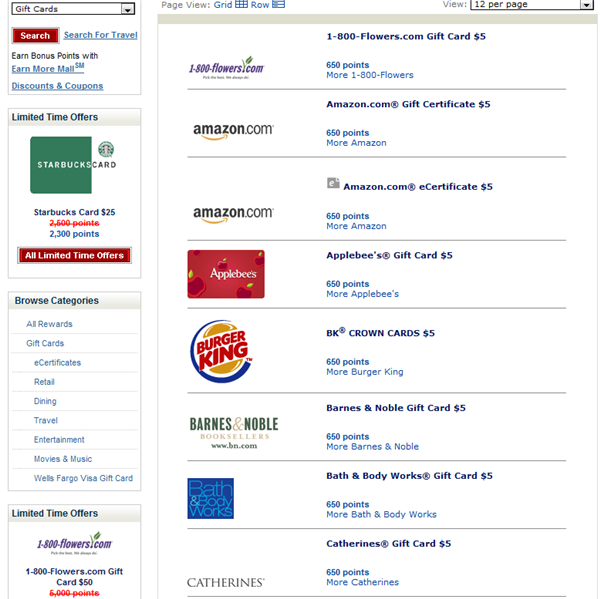

“Affordability, safety, and functionality are key with these certified accounts developed by banks and credit unions working together with local governments, community groups, and advocates,” he said. Quiñonez, founder of Mission Asset Fund.” “The Federal Deposit Insurance Corporation, along with both the IRS and the Centers for Disease Control and Prevention, directed the country to Bank On’s account-opening pages with links to open Bank On-certified accounts.Ī Wells Fargo Foundation grant is helping Mission Asset Fund support the 63 million unbanked and underbanked people in the U.S.

“The stimulus emergency was the biggest push we’ve seen at a national level for people to take seriously the ability to get direct deposit,” Mintz said. Since then, Mintz said, the more than 10 million consumers registering bank accounts with the IRS to get electronic payments faster than mailed checks under the coronavirus relief bill, along with CFE Fund’s own financial stability research, show the importance of being banked. Jonathan Mintz, the CFE Fund’s president and CEO, said that the number of Bank On-certified accounts offered nationally has grown to nearly 60 since it announced the Bank On standards in 2015, with Wells Fargo, JPMorgan Chase, Citigroup, and Bank of America offering the first certified accounts. The product’s launch comes as digital banking soars at Wells Fargo and the company eyes ways to simplify and improve its offerings.Ĭlear Access Banking meets the Cities for Financial Empowerment Fund’s Bank On National Account Standards for safe and appropriate financial products that can help people enter or re-enter the financial system. Unbanked clients who became banked and opened accounts they used regularly during counseling were almost eight times more likely to increase their savings compared to the unbanked.

Wells fargo check book cost professional#

But with the new Clear Access Banking, customers can feel at ease.Ī Cities for Financial Empowerment Fund study found that unbanked financial counseling clients were half as likely to be able to increase savings and over a third less likely to establish a new credit score, even when working closely with trained, professional counselors.

Wells fargo check book cost full#

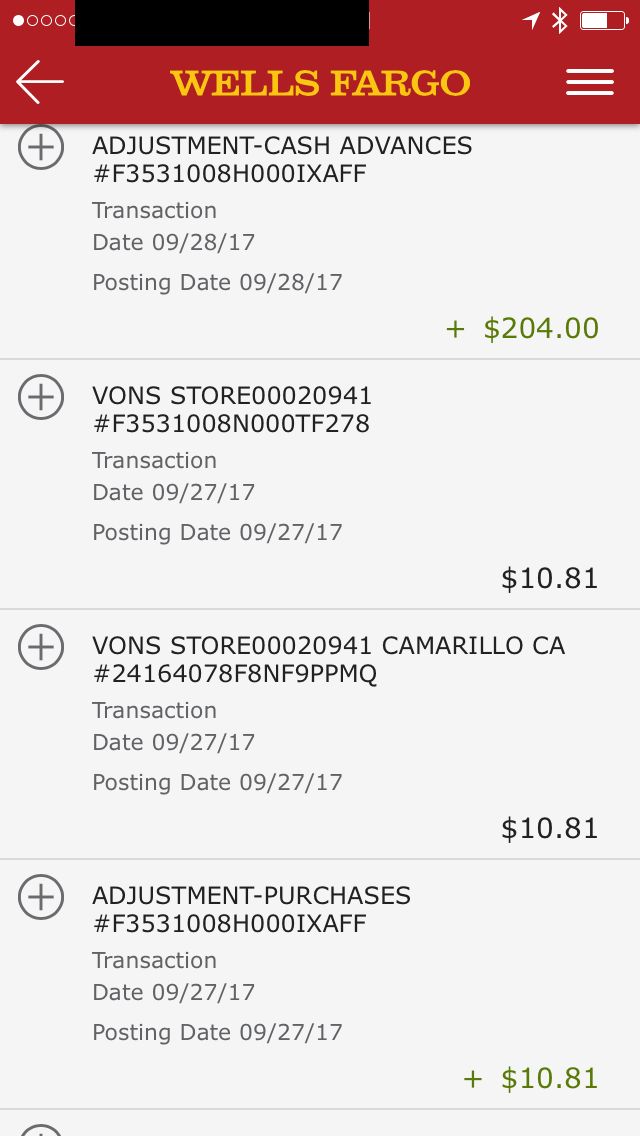

And for a flat $5 monthly fee - waived for 13- to 24-year-old primary account owners - customers can access a full array of convenient banking services, including the Wells Fargo Mobile ® app with mobile deposit bill pay and other Wells Fargo Online ® banking tools Zelle ® ATMs bank branches and 24-hour Phone Bank support.Īccording to research from The Pew Charitable Trusts, many consumers have inadequate access to safe and affordable banking products and face significant financial stress. It’s a great account to help people manage their spending, and is a convenient, modern, digital-forward product for customers not needing some of the old-school elements of a checking product like physical checks and a checkbook.” - Urmila Raghavan, leader of Consumer Deposit Product and Portfolio Management for Wells FargoĪccount holders won’t incur overdraft or nonsufficient funds fees on their Clear Access Banking account, including any caused by holds for gas, hotel purchases, or restaurant tips. “ Clear Access Banking offers a big safety net and peace of mind. Clear Access Banking SM helps customers avoid spending more than what they have in their accounts, which makes it ideal for people who are either newer to banking, like teens, or need help managing their account balances, said Urmila Raghavan, leader of Consumer Deposit Product and Portfolio Management for Wells Fargo.

0 kommentar(er)

0 kommentar(er)